Comprehensive upgrade! Li Car Series Upgrade ...

2024-03-15

Company and industry dynamics

2025-02-22

2025-02-22 01 Population and Economic Development

‣Kenya Brief

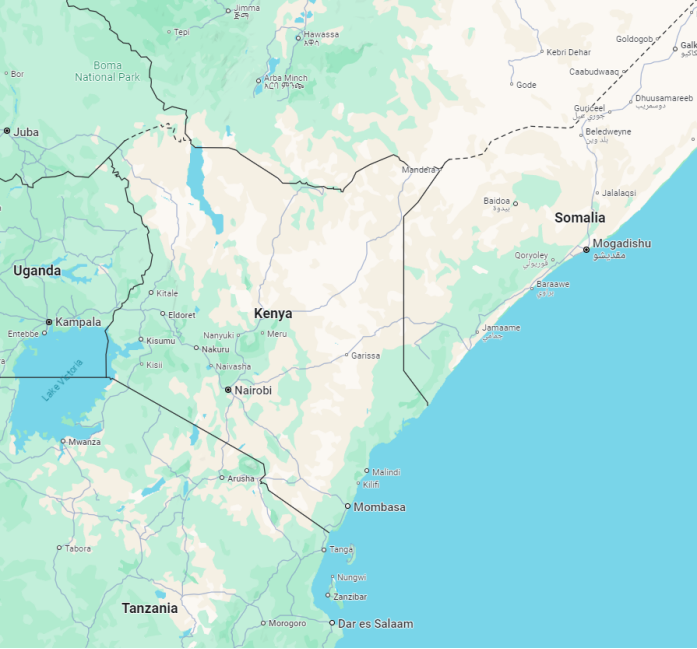

Kenya has a population of approximately 52.44 million and a land area of 582646 square kilometers.

Kenya is located in East Africa, known as the "East Gate of Africa". The equator crosses the east. It borders the Indian Ocean to the southeast and has a coastline of 536 kilometers.

Main Cities and Population:

Nairobi (capital), population 3.50 million.

Mombasa (port), population 0.90 million.

Kisumu, population 0.40 million.

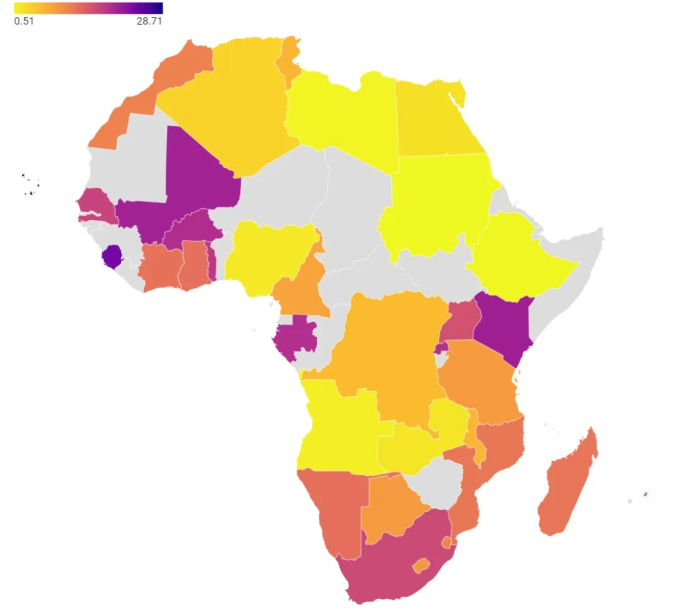

In 2023, GDP will be 144.8 billion USD (ranking fifth in Africa), and per capita GDP will be 2034 USD.

Kenya

is one of the countries in sub Saharan Africa with a relatively strong

economic foundation. Agriculture, service industry, and industry are the

three pillars of the national economy, while tea and other agricultural

products, tourism, and overseas remittances are the three major sources

of foreign exchange. Industry is relatively developed in East Africa,

with a complete range of categories and basic self-sufficiency in daily

necessities.

Kenya

was once a British colony and gained independence from Britain on

December 12, 1963.Swahili is the national language and is an official

language along with English.33.4% of Kenya's population believes in

Protestantism, 20.6% in Catholicism, 20.4% in Evangelical Christianity

and 11% in Islam.

Kenya

was once a British colony and gained independence from Britain on

December 12, 1963.Swahili is the national language and is an official

language along with English.33.4% of Kenya's population believes in

Protestantism, 20.6% in Catholicism, 20.4% in Evangelical Christianity

and 11% in Islam.

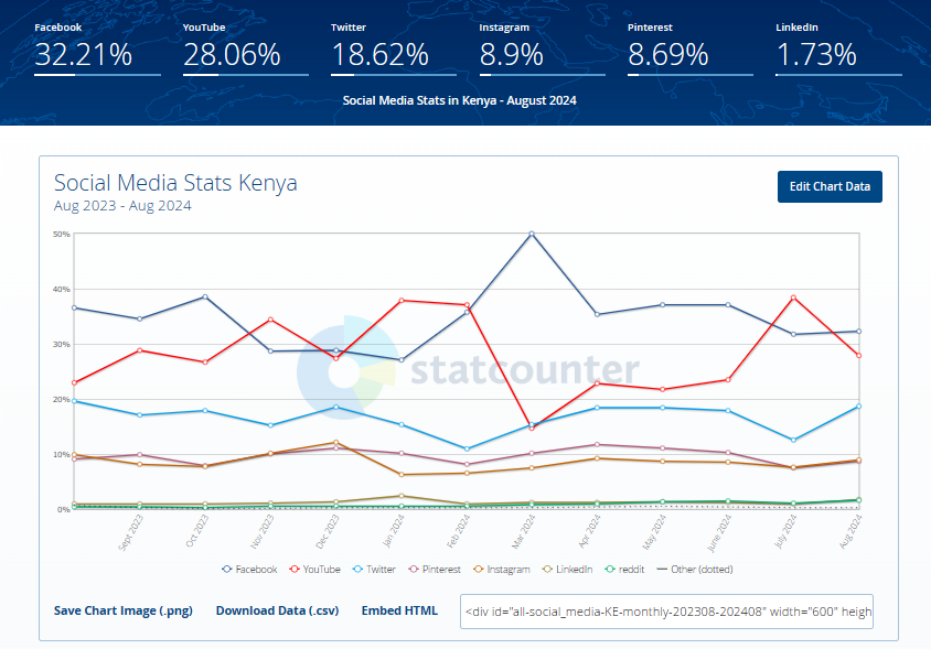

‣Proportion of main social media usage in Kenya

02 Analysis of the New and Used Car Market

02 Analysis of the New and Used Car Market

‣Automobile market in Kenya

The Kenya Automobile Industry Association stated that due to tax increases and currency depreciation, only 11370 new cars were sold in 2023, lower than the 13352 cars sold in 2022.

From July 2022 to June 2023, Kenya imported 62495 second-hand cars, of which 94.3% were from Japan.

As an advantageous country with the port of Mombasa, Kenya exports over 70% of its used cars to other African countries such as Uganda and Tanzania. According to the current laws in Kenya, it is allowed to import second-hand cars with an age of less than 8 years (calculated from the first registration of the vehicle). The cars are subject to a 25% import tax, 30% consumption tax, and 16% value-added tax, which are cumulatively paid in this order. And different taxes are levied according to the age of the car, with second-hand cars over 3 years old facing higher taxes.

Starting from April 14, 2023, Kenya has decided to "allow the use of bonded warehouses for imported used cars, placing them on the same footing as imported new cars". The use of bonded warehouses can allow importers to defer payment of import taxes, including value-added tax and consumption tax, for up to one year, boosting their cash flow situation and enabling dealers to place large orders for used cars.

The car ownership is 4.354 million units (83 units per thousand people).

The main car brands in Kenya include Mobius, Suzuki, Toyota, Honda, Mazda, Subaru, etc.

Toyota is the most popular car brand with a market share of 57.3%.

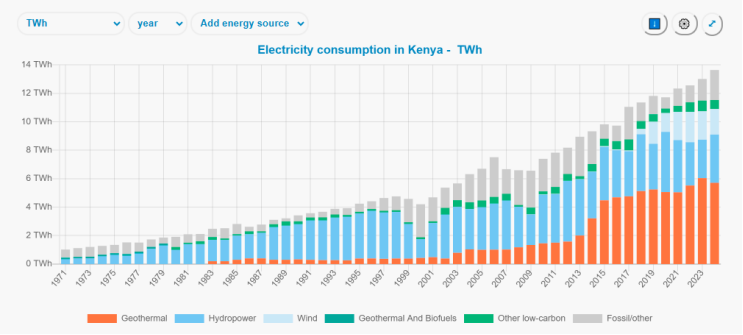

‣Energy situation in Kenya

Kenya

has abundant reserves of clean energy such as geothermal, solar, and

wind power, with geothermal, hydro, wind, and solar power accounting for

81% of the country's electricity generation. The current installed

capacity of geothermal power in Kenya is 953.7 megawatts, accounting for

45.5% of Kenya's electricity generation.

Due to five consecutive rainy seasons with insufficient rainfall, Kenya is experiencing its worst drought in 40 years.

Due to five consecutive rainy seasons with insufficient rainfall, Kenya is experiencing its worst drought in 40 years.

‣Kenya Electricity/Gasoline Price

Kenya's economic growth rate ranks among the top in African countries, and its demand for electricity has also significantly increased. However, the shortage of electricity supply and high electricity prices have become one of the main bottlenecks restricting its economic development.

Gasoline price: 187.47 KES/L (RMB 10.24)

Electricity Price: 31.85KES/kWh (RMB1.74)

‣Kenya is a right-hand drive country

‣New energy vehicles in Kenya

The Kenyan government launched the "Electric Transportation" plan in 2023, aiming to vigorously develop transportation vehicles such as electric motorcycles, electric tricycles, and electric cars, which is an important measure for Kenya to achieve green transportation and reduce air pollution. The Kenyan government also plans to build more electric vehicle charging stations.

Data shows that the registered number of electric vehicles in Kenya has grown rapidly from 475 in 2022 to 2694 in 2023. At the same time, the overall proportion of new energy vehicles is also constantly increasing. As of December 2023, among the more than 160000 newly registered motor vehicles in Kenya, the proportion of new energy vehicles has reached 1.62%.

03 Policies and Regulations

‣Import policy: Kenya prohibits the import of used cars over 8 years old

‣Import vehicle taxation

Used cars within 3 years: 25% import tax, 30% consumption tax, and 16% value-added tax, all of which are subject to cumulative taxation.

Second hand cars between 3 and 8 years old: an additional 14% will be added to the above tax base.

04 SWOT analysis

‣Advantage: The government attaches great importance to electric vehicles and provides preferential policies for imports and local assembly

‣Disadvantage: Right wheel drive vehicles, the market is mostly dominated by Japanese brands

‣opportunity:Gasoline needs to be imported, while Kenya has high inflation and a shortage of foreign exchange; The electricity price is not cheap, but the power supply mainly comes from domestic geothermal, hydroelectric, and wind power generation; The government is promoting the development of pure electric vehicles.

‣Threat: None.

Hot News

Hot News

2024-03-15

2025-02-22

2025-08-13

2025-02-22

2025-02-27

2025-10-14

2025-09-18

2025-09-29

2025-12-16

TOP