Comprehensive upgrade! Li Car Series Upgrade ...

2024-03-15

Company and industry dynamics

2025-02-27

2025-02-27 The United Arab Emirates is located in the eastern part of the Arabian Peninsula, with its capital Abu Dhabi covering an area of 84000 square kilometers. The United Arab Emirates is one of the three major entrepot trade centers in the world. As the largest commodity distribution center in the Middle East and even Africa, 60% of the goods imported by the United Arab Emirates can radiate to more than 50 countries and regions in the Middle East, Africa and Eastern Europe along the "the Belt and Road", with broad market potential.

As a new energy vehicle brand focused on going global, ZMEV has established mature international routes for vehicle customs clearance and shipping, including "Shanghai to Dubai".

UAE automotive market

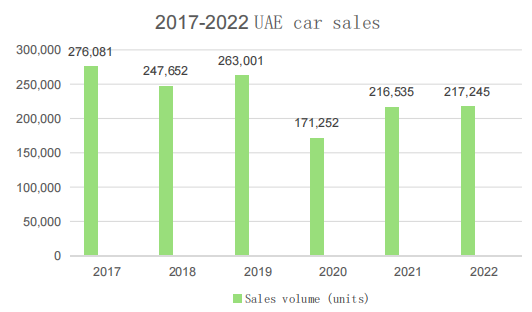

·Overall, car sales are on the rise

The total sales volume of the UAE automobile market in 2022 was 217245 units, an increase of 0.3% compared to 2021.

Affected by the 2008 financial crisis, the UAE automotive market performed well from 2010 to 2015, with sales increasing from 213072 units in 2010 to 408154 units in 2015, more than doubling.

However, in the second half of 2015, due to a significant decline in oil revenue and the implementation of contractionary fiscal policies, purchasing power decreased and this growth was disrupted. The market began to decline in 2016, and in 2018, the government imposed a 5% value-added tax, causing annual sales to fall to 247652 vehicles.

In 2019, like other markets in the region, the UAE market began to recover, with annual sales reaching 263001 vehicles, an increase of 6.2% over the previous year.

Due to the pandemic, sales declined in 2020, with 171252 units sold throughout the year, a decrease of 34.9% compared to 2019. In 2021, sales hit bottom and rebounded, with new car sales reaching 216535 units, a year-on-year increase of 26.4%.

·MG enters the top ten in sales for the first time

In the United Arab Emirates, four-wheel drive off-road vehicles are the most popular, followed by sports coupes and hatchbacks. From a brand perspective, Toyota and Nissan are the most popular car brands, while brands such as Mercedes Benz, BMW, and Mitsubishi Ford also have high market demand.

In terms of brand sales in 2022, Toyota led with 66504 units (+13.4%), followed by Nissan with 32997 units (-6.4%), and Mitsubishi with 28577 units (+10.6%).

China MG continues to maintain rapid growth, with sales increasing by 87.1% compared to 2021. Thanks to its outstanding performance in 2022, its ranking has jumped 8 places and remained stable at 8th place.

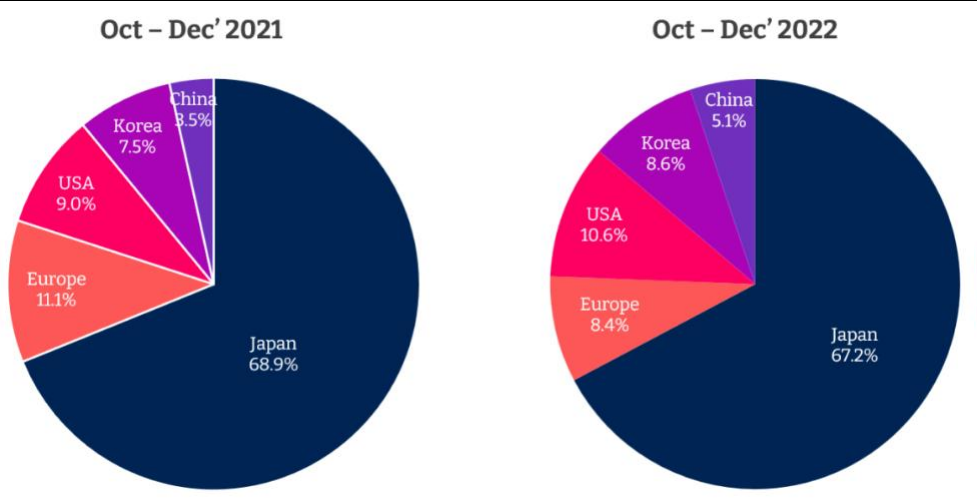

·Chinese car manufacturers are growing rapidly in the United Arab Emirates

In just three years, Chinese automakers have firmly established themselves in the UAE automotive market.

Factors contributing to the success of Chinese automakers in the UAE automotive market:

1.Competitive pricing and cost-effectiveness

2.Diversified product portfolio

3.Improved quality and technology

4.Strategic partners and localization efforts

5.Focus on electric vehicles (EVs)

6.After sales support and warranty plan

The electric vehicle market in the UAE

·Emerging electric vehicle market

The electric vehicle market in the United Arab Emirates is currently in its early stages, but growing rapidly.

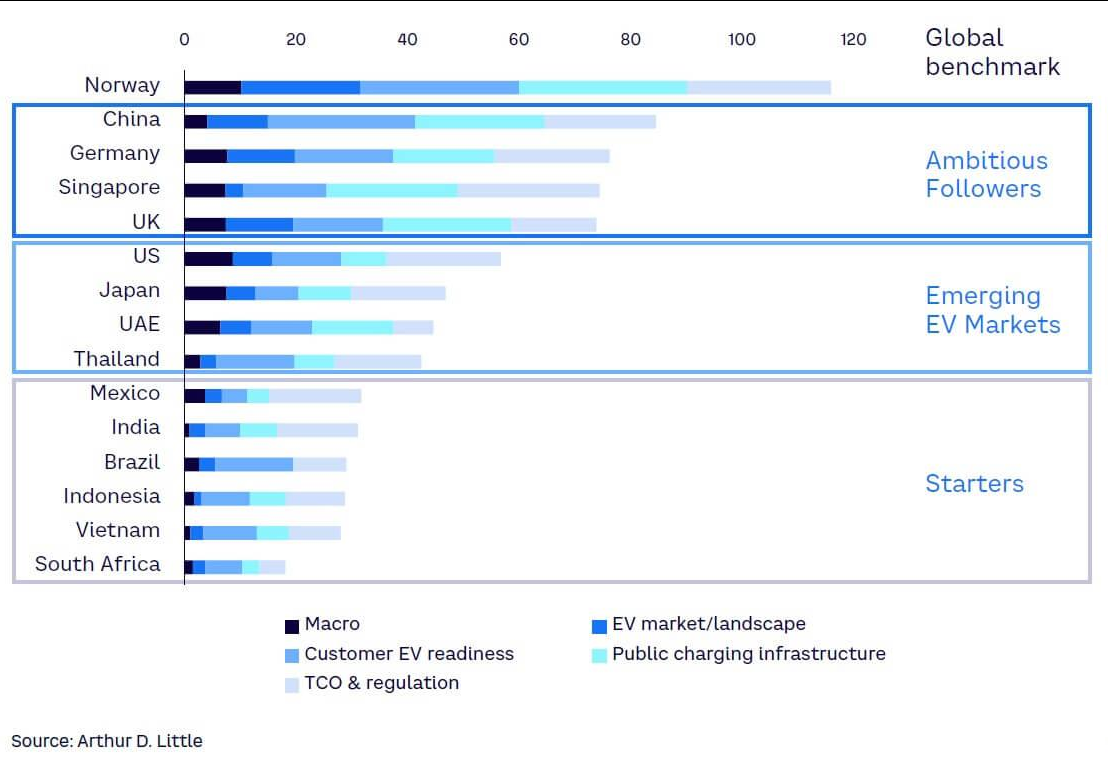

According to the "2022 Global Electric Vehicle Readiness Index" released by international consulting firm Arthur D Little last year, the United Arab Emirates ranks eighth in the world in terms of electric vehicle readiness and is classified as an "emerging electric vehicle market".

The report also predicts that the electric vehicle market in the UAE will grow at a rate of 30% per year between 2022 and 2028, representing enormous market potential.

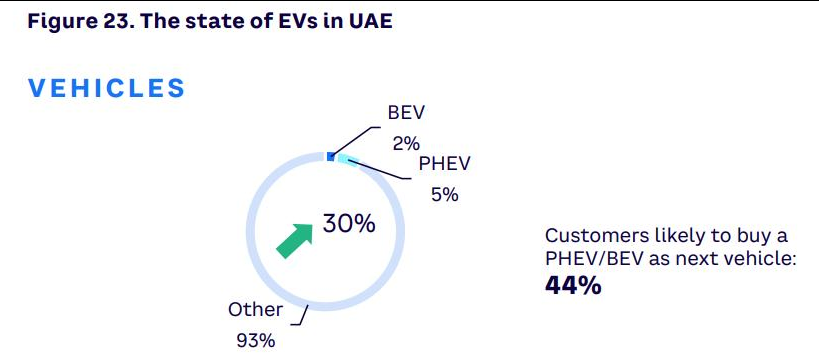

·The EV market is in its early stages, but has enormous potential

The sales of electric vehicles in the UAE are growing rapidly, and with the government introducing national policies to support the industry's growth, it is expected that the sales of passenger electric vehicles in the UAE will increase by 32% this year.

Car buyers in the UAE often own multiple cars, with electric vehicles serving as their auxiliary vehicles. Compared to other countries in the region, this market has seen greater growth in the adoption of high-end electric vehicles, with affordability being an important factor.

According to Arthur D Little's survey, about 44% of UAE residents are considering switching to hybrid or pure electric vehicles as fuel prices rise.

·UAE electric vehicle brand

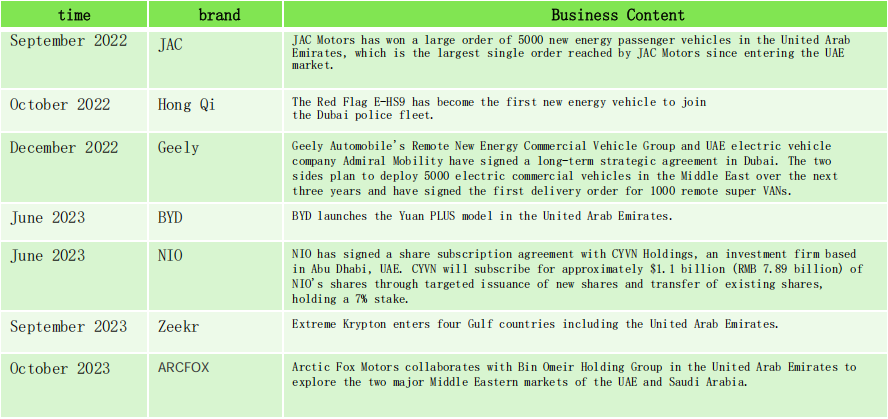

·Chinese electric vehicle companies head to UAE

·UAE policies related to electric vehicles

UAE charging infrastructure

·Plan a comprehensive tram charging network

To support the continuously developing electric vehicle industry, the UAE plans to build an electric vehicle charging network nationwide. Dubai Electricity and Water Authority stated that by the end of 2022, there will be 620 public charging stations in Dubai. The goal is to establish 1000 public charging stations in Dubai by 2025.

At the beginning of this year, Abu Dhabi National Oil Company and Abu Dhabi National Energy Company announced the establishment of a joint venture dedicated to developing electric vehicle infrastructure. The company is expected to invest $200 million to install 70000 charging stations by 2030.

Import and export of automobiles in the UAE

·Distribution of UAE automobile import and export countries

In 2021, the UAE's automobile imports reached 9.3 billion US dollars, making it the 19th largest automobile importer in the world and the 5th largest imported product in the UAE. The UAE mainly imports cars from the following countries: Japan (2.43 billion US dollars), the United States (1.85 billion US dollars), Germany (1.03 billion US dollars), Oman (561 million US dollars), and Thailand (485 million US dollars).

In 2021, the UAE's automobile exports reached 5.37 billion US dollars, making it the 25th largest automobile exporting country in the world, and automobiles are the 9th largest export product of the UAE. The main destinations for UAE car exports are Iraq ($970 million), Saudi Arabia ($629 million), Oman ($619 million), China ($362 million), and Jordan ($205 million).

·The situation of the second-hand car market in the UAE

The United Arab Emirates is a left-hand drive country with approximately 354 cars per thousand people. Mainly importing used cars through ports such as Jebel Ali, Abu Dhabi, and Sharjah. Dubai, the largest city in the country, serves as an international trade center for used cars and has also established a free zone called Dubai Auto City, dedicated to the export of used cars.

The entire Dubai Motor City covers an area of approximately 1 million square feet and aims to export used cars to Asian and African markets. Enterprises that settle in Dubai Motor City can enjoy preferential policies such as wholly foreign-owned establishment of companies, exemption from corporate income tax for 50 years, exemption from personal income tax, and exemption from import and export tariffs.

·UAE Used Car Import Policy

(1) Import policy

The age of imported second-hand cars shall not exceed 4 years, and both left-hand drive and right-hand drive vehicles can be imported. But one thing to note: right-hand drive vehicles cannot operate on

It is registered domestically and cannot be driven on the road, but can be transshipped. All vehicles arriving in the United Arab Emirates must accept the UAE

Customs inspection or evaluation. The following vehicles are absolutely prohibited from importation:

Vehicles previously used as taxis or police cars;

Vehicles with colored windows (otherwise fines will be imposed and replacement of windows that meet the requirements will be required);

Scrapped cars, accident cars, passing trains, and water damaged cars.

(2) Tax Policy

Imported second-hand cars are subject to a 5% customs duty and a certain percentage of value-added tax based on the age of the car. In addition, after the customs inspect the vehicles, verify whether the export declaration value is correct. If it is inconsistent, the difference still needs to be paid. For second-hand cars in transit, tariffs are exempted.

Hot News

Hot News

2024-03-15

2025-02-22

2025-08-13

2025-02-22

2025-02-27

2025-10-14

2025-09-18

2025-09-29

2025-12-16

TOP