Comprehensive upgrade! Li Car Series Upgrade ...

2024-03-15

Company and industry dynamics

2024-09-30

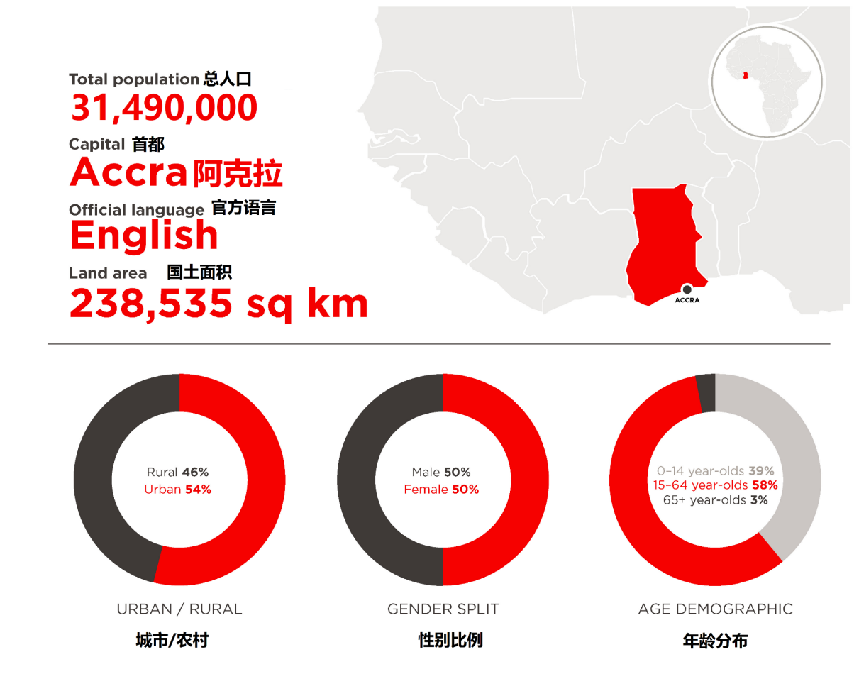

2024-09-30 The Republic of Ghana, abbreviated as Ghana, is a country in West Africa located on the north coast of the Gulf of Guinea. It has abundant natural resources such as gold, diamonds, and oil, and its economy is mainly based on agriculture, particularly exports of gold, cocoa, and timber. Ghana is known as the "land of cocoa" and is hailed as one of the fastest-growing economies in Africa. It boasts unique cultural heritage, music and dance, as well as a variety of handicrafts and cultural festivals. In addition, Ghana is also one of the top ten tourist countries in Africa, with major cities including the capital city Accra and the second largest city Kumasi. Ghana has good diplomatic relations with China, and China has provided significant economic assistance to Ghana.

01 Population and Economic Development Situation

‣Overview of Ghana

The Republic of Ghana is a country in West Africa, also known as the Gold Coast. Its main cities are Accra with a population of 4.2 million and Kumasi with a population of 2 million. It was once a colony of Britain for a long time, based on British common law and customary law, with a relatively sound legal system.

In 2021, the Gross Domestic Product (GDP) was 75.5 billion US dollars, with a per capita GDP of approximately 2413 US dollars. In 2023, exports of gold will be 7.6 billion US dollars, oil will be 3.8 billion US dollars, and cocoa will be 2.1 billion US dollars. Import fuel, automobiles, machinery, and food in 2023. The lithium ore reserves are 180000 tons.

*China is Ghana's largest importer of steel, vehicles and accessories, chemical products, machinery and electronic equipment.

·Shortage of US Dollar - "Gold for Oil" Plan

·Currency depreciation (Ghana Cedi) -27.9% (against US dollar, 1 year)

·Inflation 22.8% (June 2024 YoY)

·Lending Rate: The benchmark interest rate is 29.5%, and the loan interest rate is 50%.

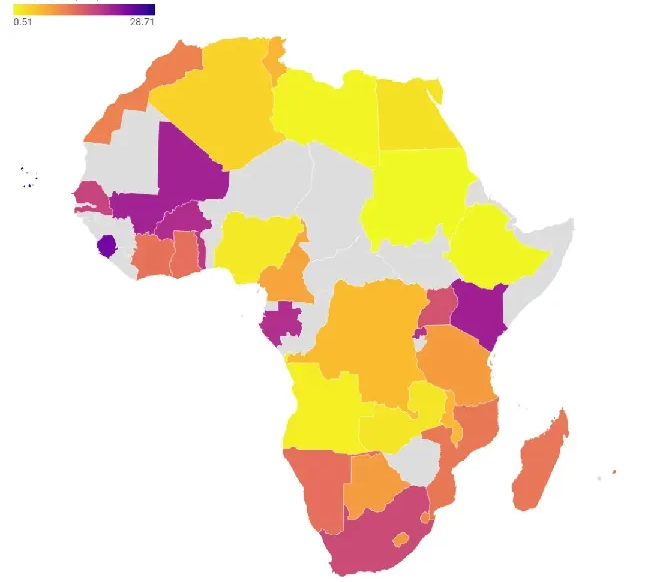

‣Western Community - Economic Community of West African States, abbreviated as ECOWAS. The total area of member states is 5.11 million square kilometers, with a population of approximately 320 million, accounting for nearly one-third of the total population of Africa.

·15 member countries: Benin, Burkina Faso, Togo, Cape Verde, Gambia, Guinea, Guinea Bissau, Ghana, C ô te d'Ivoire, Liberia, Mali, Niger, Nigeria, Sierra Leone, Senegal. Nigeria is the largest country and economy in Africa, as well as the core of the Western Community, with a population of 220 million and a GDP of 47.26 billion US dollars. Ghana is the second largest economy in West Africa.

·The Unified External Tariff of the Western Community: Import tariffs are divided into four levels: 0%, 5%, 10%, and 20%.

02 Analysis of the New and Used Car Market

‣Ghana is a country with left-hand drive cars

Install 4700 vehicles. Second hand car sales amounted to 114000 units.

·The main sources of second-hand car imports are the United States (Japanese brands), Japan, South Korea, Germany, and China. Among them, Japan exports a large number of used cars to Ghana every year through methods such as steering modification.

·Kantanka vehicles are assembled in Ghana using spare parts kits provided by a Chinese company, Fodi Motors, through Chongqing DaTech. We mainly produce sedans, SUVs, and some military vehicles.

·Rana Motors - Kia Assembly Plant (pictured below)

‣The 10 most popular car models in Ghana

‣Ghana Electricity/Gasoline Prices

Gasoline price: 0.95 EUR/L (RMB 7.5)

Electricity price: 0.1251EUR/kWH (RMB 1.015)

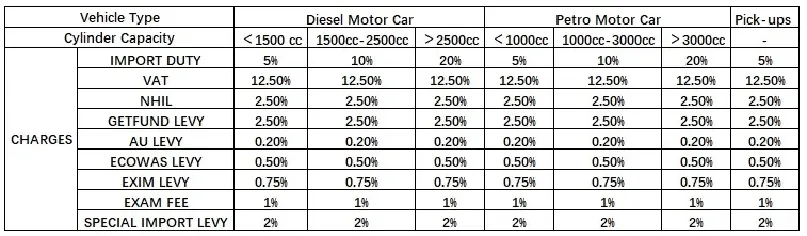

03 Policies and regulations

‣Import Policy

Import tariffs are divided into four levels: 0%, 5%, 10%, and 20%: passenger cars (see table below), buses: second-hand buses with 10 to 30 seats have a tariff of 5%, and second-hand buses with 30 or more seats have a tariff of 0%; Truck: Only a 5% tariff is charged on goods transportation vehicles.

·Value added tax (VAT) is 12.5%

·The national health insurance levy is 2.5%

·Export Development Fund (EDIF) levies 2.5% of vehicle CIF

·The African Union levies a tax of 0.2%

·Economic Community of West African States levy 0.5% tax

·Import and export tax 0.75%

·The inspection fee is 1%

·Special import tax of 2%

* Import ban: Used and scrapped cars over 10 years old

Total import taxes: 31.95% for gasoline vehicles (1.6L) and 21.95% for electric vehicles (0% tariff)

Ghana's National Electric Vehicle Policy

On December 19, 2023, Ghanaian President Nana Addo Dankwa Akufo Addo launched the National Electric Vehicle (EV) Policy. Ghana's recent budget regulation exempts electric vehicles used for public transportation from import tariffs for 8 years, which is seen as a step in the right direction. The same 8-year tax exemption policy is also implemented for semi bulk and fully bulk electric vehicles imported into the country by registered electric vehicle assembly companies. Ghana plans to utilize its excess electricity capacity, with a peak power of 3561 megawatts and an installed capacity of 5231 megawatts in its power grid.

Ghana plans to utilize its excess electricity capacity, with a peak power of 3561 megawatts and an installed capacity of 5231 megawatts in its power grid.

Between January 2017 and December 2021, approximately 17660 plug-in electric vehicles (PEVs) were imported into Ghana. 96% of them are electric two wheel and three wheel electric vehicles (E2&3W). The majority (98%) of pure electric vehicles (BEVs) are imported from China.

‣Policy Objectives

·Renewable Energy Plan

·Promote photovoltaic roof plans for public and private buildings

·Promote the installation of charging stations

04 SWOT analysis

‣Strengths

Low cost and high availability of electricity

Domestic cars have price advantages and broad market prospects

‣Weaknesses

Low awareness of domestic brands

The current market is mainly dominated by Japanese, Korean, and European car brands

Unfamiliarity with the local market and lack of established channels

‣Opportunities

The Ghanaian government vigorously promotes the import of electric vehicles and infrastructure

Pure electric vehicles (BEVs) are scarce in stock and are sporadically imported from China

‣Threats

Shortage of foreign exchange, currency depreciation, and inflation

Domestic parallel exporters are biased and the market is occupied

Popular News

Popular News

2024-03-15

2024-10-15

2024-09-30

2024-09-29

2024-09-30

2024-11-21

2024-11-13

2024-12-04

2024-12-10

TOP