Comprehensive upgrade! Li Car Series Upgrade ...

2024-03-15

Company and industry dynamics

2024-09-30

2024-09-30 Market Overview

Mexico is the sixth largest automobile production base in the world, and its automobile production is mainly influenced by the North American automobile market. In 2023, Mexico's automobile production will reach 3.78 million units, far exceeding domestic sales, most of which will be exported,mainly to North America, especially the United States. Mexico is the fourth largest exporter of light vehicles in the world, with a high proportion of its exports in total production, demonstrating its important position in the international automotive market.

Although the Mexican automobile market has relatively small domestic sales, it has enormous potential and influence as an important part of global automobile production and export. In recent years, with the recovery of the economy and the gradual recovery of the automotive market, Mexican car sales have also increased.

Core viewpoints

The United States is an important automobile exporting country for Mexico, and policy and cost advantages will become important growth points in the future. In 2022, Mexico's passenger car production reached 3.3 million units, ranking sixth in the world, and the value of automotive parts reached 110.5 billion US dollars, ranking fourth in the world. The United States is its main export country (with 2.22 million passenger cars exported to the US in 2022 and $60.1 billion worth of automotive parts exported to the US in 2021), and the automotive manufacturing industry mainly focuses on traditional fuel vehicles. The USMCA and the Anti Inflation Reduction Act are expected to further enhance its position in the North American new energy vehicle manufacturing industry.

Tesla plans to build a super factory in Mexico, which is expectedto become a global core production base. Tesla, as a global new energy vehicle company, announced the construction of a super factory in Mexico. According to official disclosures from Mexico, Tesla is expected to invest an initial $5 billion in a new factory covering 4200 acres. The first phase of production capacity planning for the Mexico factory is expected to reach 1 million units per year (the Shanghai factory covers an area of 212 acres and has a production capacity of 1 million units). With the promotion of policies and industry trends, the production capacity is expected to continue to expand in the later stage, becoming Tesla's global core production base.

Unique Automotive Demand Culture

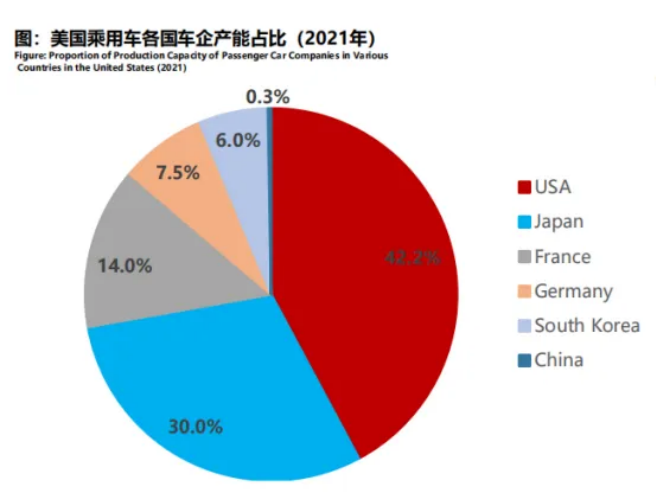

Led by American/Japanese brands, global car companies have implemented their layout in the United States. As of 2021, the total automobile production capacity in the United States has reached 10.74 million units, with American brands accounting for 42.2%, Japanese brands accounting for 30.0%, and French brands (Stellantis, a joint venture between FCA and Chrysler, including Alfa Romeo, Maserati, Jaguar, and Jeep) accounting for 14.0%. American and Japanese brands dominate the production capacity.

In response to market demand, pickup truck+SUV production capacity has become mainstream. Based on the preferences of local consumers for SUV and pickup truck models, the production capacity of domestic passenger car brands in the United States is mainly focused on these two types of models. Brands such as General Motors/Ford/Stellantis/BMW/Mercedes Benz have the vast majority of production capacity for SUVs and pickup trucks, with only some car companies having production capacity for A-class sedans and luxury sedans.

North American import dependence continues to grow

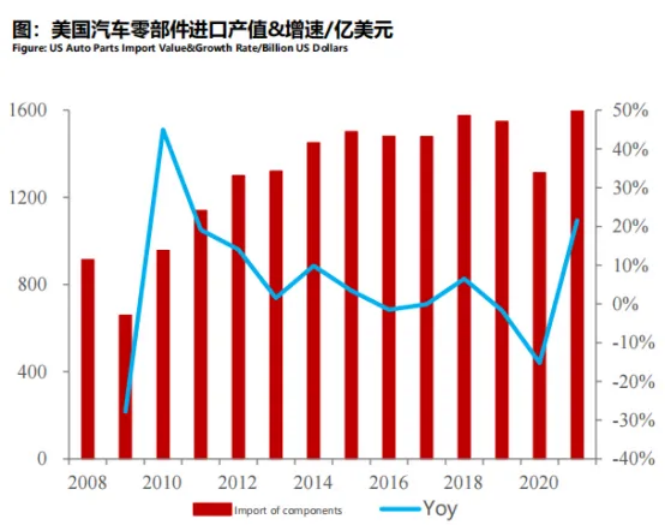

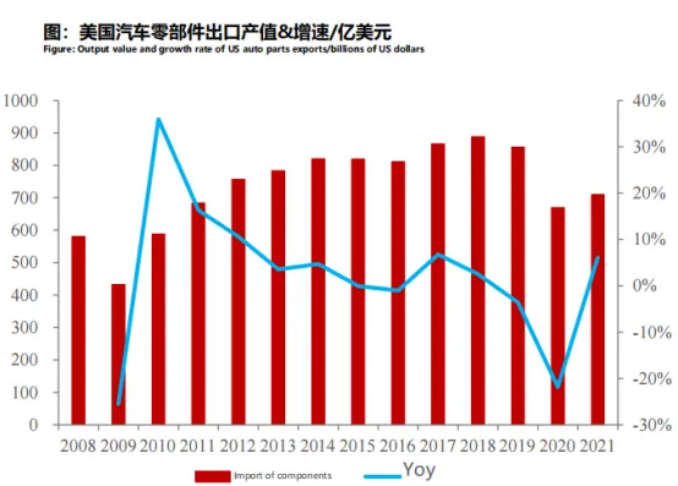

There is a trade deficit in the import and export of automotive parts, and vehicle production is completed through imports. Compared to vehicle manufacturing, the parts sector is located at a higher upstream and has stronger manufacturing attributes. Therefore, after the 2008 financial crisis, the parts sector shifted its production capacity faster to the outside of the United States compared to vehicle manufacturers. The import amount of automotive parts in the United States has been increasing year by year, reaching a new high of 159.6 billion US dollars in 2021, with a difference of 88.7 billion yuan between the import and export amounts of parts.

In the post pandemic era, the demand for imported automotive parts has increased, and the pace of exports has slowed down. In 2020, due to the impact of the epidemic, the import and export data of parts decreased significantly. After the lifting of the epidemic in the United States in 2021, the import value of parts reached a new high, but the pace of parts exports slowed down significantly, and the demand for parts imports in domestic vehicle manufacturing further increased.

Mexican preference for imported car models in the country

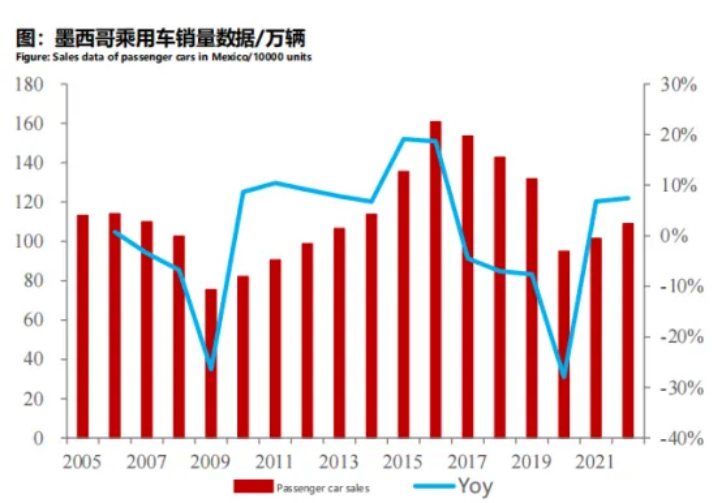

Domestic automobile consumption has been under significant pressure in recent years due to fluctuations in the macroeconomic environment. From 2005 to 2014, Mexico's annual automobile consumption remained stable at around 1 million units. From 2014 to 2016, due to the continuous improvement of the country's macroeconomic situation and the strengthening of the crackdown on illegal imported second-hand cars, sales continued to rise, reaching 1.6 million units in 2016. Subsequently, due to the macroeconomic downturn and the impact of the pandemic, sales decreased, resulting in a domestic passenger car sales volume of 1.09 million units in 2022.

More than half of the passenger cars are imported, and consumers prefer imported models. In the sales of passenger cars in Mexico, imported models from overseas account for a larger share, reaching 67.4% in 2022. The main reason is that the domestic automobile production capacity is mainly established to meet the habits of American consumers, while the purchasing needs of Mexican domestic consumers need to be met through imports.

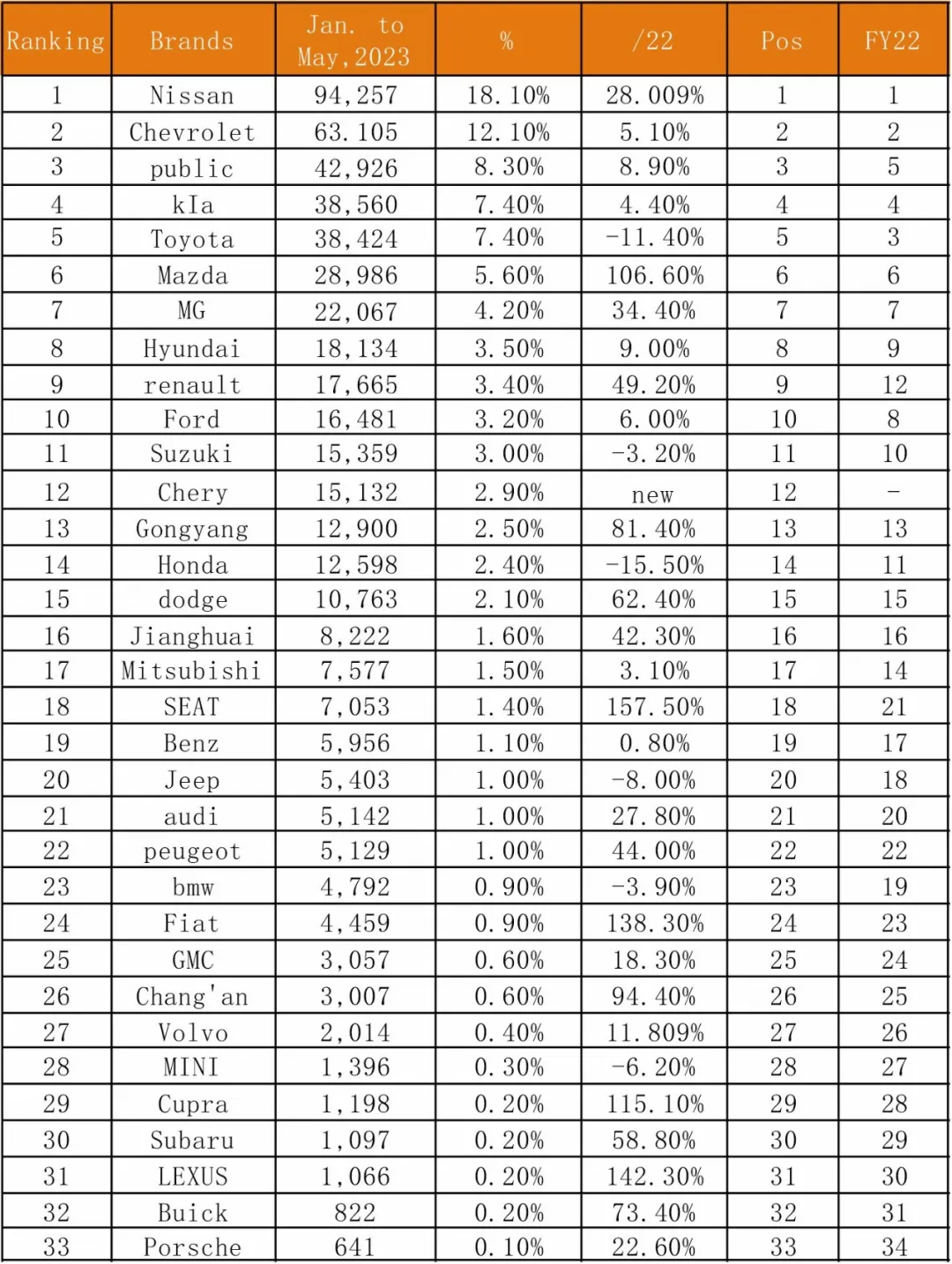

From January to May 2023, the top 50 car brands in Mexico by total sales are as follows: Challenges Faced

Challenges Faced

The trade war between China and the United States has exceeded expectations. The escalation of US sanctions on the trade war has led to an increase in local production capacity trade barriers in Mexico, which may have an impact on the profitability of companies.

The price war for passenger cars exceeded expectations. The market has entered the stage of stock game, and competition among brands is becoming increasingly fierce. Price wars may lead to cost pressures for car companies being transmitted to upstream supply chain enterprises.

Popular News

Popular News

2024-03-15

2024-10-15

2024-09-30

2024-09-29

2024-09-30

2024-11-21

2024-11-13

2024-12-04

2024-12-10

TOP